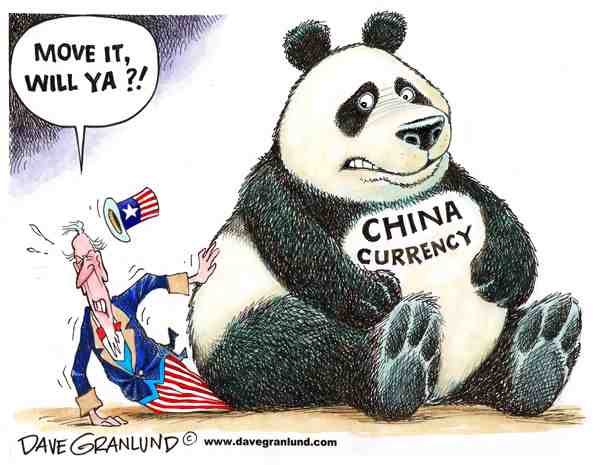

Gotta love them pandas

I recently came across this

10 page article (if you print it out) about how the Chinese Government controls certain economic and political aspects of the country. As I read through two things started to happen; I become more and more curious,

at the same time even more clueless about what they are doing - a total paradox. But keeping to the point, let me just elaborat on what they're doing as of now;

Now to put it in simple terms, the Chinese Government has a policy where, for transactions conducted in US Dollars, all the money has to be forwaded to their Central Bank, which is then to be exchanged with the Yuan Renmibi - this is apparently a must as they treat dollars as contrabands! Now what do they do with the money? They buy US Dollar denominatd government bonds. Now, if the buying of bonds were only limited to millions, I can understand, but apparently it runs in the billions (refer to chart below).

This is the prime reason why some governments are crying foul play; as this is the prime reason why their currency is undervaluated - to a point where the American Congress nearly went through the Exchange Control Act, and could be the reason why they've been targeted for

Trade Protectionist Policies. If you look at their exchange rate, for a period of two years - there have been miniscule if not

no major volatility against their exchange rate with the USD, even during the 08/09 financial crisis.

So what does this show? Clearly, a sign of government intervention. Many had hoped for the Chinese Government to change after their ascension into WTO - but apparently based on two articles from the Economist; much of their

economic policies and

political structure remains the same despite a significant amount of pressure to become "Westernize" and open up their market. This system apparently is much resented by the Chinese Government who prefers to have a stake (even a small one) in all if not the majority of the private entities running in China; for the sole purpose of control.

Now, in actuality, what the world is concerned about is their

transparency - What do they plan on doing with the bond? There have been speculations that once reaching a certain threshold, they would do a firesale - but this would in turn hurt them as well as a healthy American economy would be essential to their Export-Driven economy, to which America is a big customer. So if this isn't the case, why don't they spend the money domestically? Why bother buy bonds when you can build infastructure? Well the answer to this is apparently as they build more and more manufacturing plants, major constructions shifts to public utilities would drive their inflation rate to the moon - and when that happens,

a global rise in inflation would eventually come.

I believe that this is something long term - my experience which Chinese people, regardless of where they are born is that they have two distinct characteristics; the natural ability to make money and a very good long term vision. So whatever most pundits perdict in the moment is particularly off track - only the Chinese would know, and I'm pretty sure its something more which would develop within the following decades rather than years.

In any case, keeping the world in the dark would only result in the Chinese Government open to scrutinization by the Western Media and Government. What I can see is definitely, a clash of ideologies from the Capitalist West, to the Communist / Socialist East. Within the coming decades, we would probably see a second Cold War; using not spies as weapons but rather dollars, purchasing power and economic influence.

Thats something new to look forward to.